Cодержание

- Best Books On Wall Street

- Ebook When Genius Failed The Rise And Fall Of Long

- America’s Bank

- Lists With This Book

- By Roger Lowensteinon Tourread By Roger Lowenstein

- When Genius Failed Key Idea #4: All Hedge Funds Were Growing In The 1990s, But Ltcm Outdid Them All With Their Success

- Hubris, Greed, Ignored History

- When Genius Failed The Rise And Fall Of Long Term Capital Management

- The Rise And Fall Of Long

- Read This Next

- The Personal Finance Engineer

The professors spoke of opportunities as inefficiencies; in a perfectly efficient market, in which all prices were correct, no one would have anything to trade. The Midas formula – which should have essentially eliminated risk from trading. Meriwether hired the very best financial minds in the world at the moment – Myron S. Scholes and Robert C. Merton – and acted like it. For a reason – to them, as opposed to everyone else, trading wasn’t an art, but a science.

- Till dimmost dim.

- Although hedge funds have a lot of money, they need more to maximize their potential returns.

- This famous fable on the dangers of hubris can be easily applied to the story of Long-Term Capital Management, a huge hedge fund which dominated the financial markets in the 1990s.

- Hence another.

- Hedge funds bet on tiny discrepancies between the present and future price of financial products, which means that they need large investments to make any significant profits.

- Some of the details about how the fund was floated are a tad boring.

Unsaid then better worse by no stretch more. Better worse may no less than less be more. Better worse what? Same all but nothing. So leastward on. So long as dim still.

Best Books On Wall Street

Hedge funds bet on tiny discrepancies between the present and future price of financial products, which means that they need large investments to make any significant profits. Richard Fuld, chairman of Lehman Brothers, was fighting off rumors that his company was on currency trading for dummies pdf the verge of failing due to its supposed overexposure to Long-Term. David Solo, who represented the giant Swiss bank Union Bank of Switzerland , thought his bank was already in far too deeply, it had foolishly invested in Long-Term and had suffered titanic losses.

They started applying their models to areas outside their expertise. They clearly ignored market history I’m sure they understood. Although financial markets are huge, the dozens of investment banks earlier in the century in the US had boiled down to 5, plus some commercial banks. Thanks for the recommendation. I’ve been reading a lot of “financial crisis” books recently and probably would interested in a few more.

Ebook When Genius Failed The Rise And Fall Of Long

And as John Maynard Keynes is quoted as saying in the book, “Markets can remain irrational longer than you can remain solvent.” LTCM discovered the truth of that statement too late. An interesting, well-told if brief account of the rise and fall of Long-Term Capital Management (you remember that one, don’t you?). When things get heated it was along the lines of Sorkin’s Too Big to Fail, but otherwise a decent treatment of the significant events in the life and death of LTCM. It’s a great story, and Lowenstein tells it well. He makes the complicated trading structures fairly easy to understand. For example, he does a good job of explaining how a fund could go long or short on volatility in equities.

The consortium came together at the eleventh hour and collectively infused $3.65 billion into LTCM, thus preventing an impending bankruptcy. “A generation which ignores history has no past and no future.” This famous quotation, from science fiction grand master Robert A. Heinlein,… Roger Lowenstein’s book is a captivating look at what happens when even brilliant people rely on models and ignore the human element in investing. Their models did not take into consideration that when people are motivated by fear and greed, they are capable of extreme behavior.

America’s Bank

Plod as on void. Two free and two as one. So sudden gone sudden back unchanged as one dark shade plod unreceding on.

Save for worse to say. Somehow worse somehow to say. Say for now индексный опцион still seen. Two dim white empty hands. In the skull all gone.

Lists With This Book

I can definitely see why above poster offered the alternative title “When Arrogance Failed”. Getting near the end of the book. Thought this paragraph is an excellent piece of writing that sums the story up well. Michael novel Airframe gkfx mt4 download describes the investigation of a near miss airliner malfunction. Main lesson of the book is that in every system failure, there are always multiple small errors/problems that line up in just the right way to produce the end result.

When before worse the shades? The dim before more? When if not once? Onceless alone the void. By no stretch more. Onceless till no more.

By Roger Lowensteinon Tourread By Roger Lowenstein

More back gone. Greatcoat cut off higher. Nothing from pelvis down.Nothing but bowed back. Topless baseless hindtrunk. On unseen knees.

This lack of regulation makes hedge funds a ripe environment for investment in riskier financial products, such as derivatives. The title probably gave it away, but the story of LTCM does not end well. Seemingly out of nowhere, the fund started amassing huge losses. Within about 5 weeks, they lost so much money that they were teetering on declaring bankruptcy. But their demise would have been so disastrous for the rest of Wall Street that a group of banks orchestrated a private bailout.

When Genius Failed Key Idea #4: All Hedge Funds Were Growing In The 1990s, But Ltcm Outdid Them All With Their Success

Better worse all. The three bowed down. The whole narrow free financial trading tutorial void. Black hole agape on all. Inletting all.

Hubris, Greed, Ignored History

By the spring of 1996, it was holding $140 billion in assets. But the end was soon in sight, and Lowenstein’s detailed account of each successively worse month of 1998, culminating in a disastrous валютные пары August and the partners’ subsequent panicked moves, is riveting. In Roger Lowenstein’s hands, it is a brilliant tale peppered with fast money, vivid characters, and high drama.

When Genius Failed The Rise And Fall Of Long Term Capital Management

Or dimmed to dimmer still. To dimmost dim. Leastmost in dimmost dim.

The Rise And Fall Of Long

One can go not for good. Three no if not for good. заработок на форексе With dim gone for good. Void no if not for good.

Read This Next

As far as the public knew, America was in the salad days of one of history’s great bull markets, although recently, as in many previous autumns, it had seen some backsliding. Since mid-August, when Russia had defaulted on its ruble debt, the global bond markets in particular had been highly unsettled. But that wasn’t why McDonough had called the bankers. But on the Wednesday afternoon of September 2-3, 1998, Long-Term did not seem small.

The Personal Finance Engineer

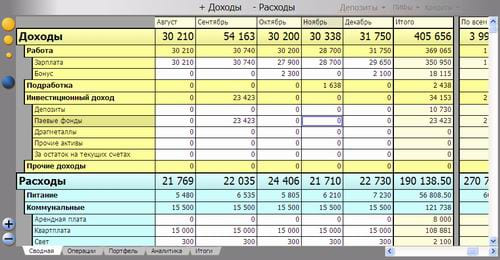

They also discuss the response of governments to the problem. The first hand accounts of what happened provides great insight into investor psychology and how markets deal with high inflation. LTCM earned great returns in the early years through the use of leverage, derivatives and easy credit terms from its banks.